Nonprofits often receive donations or grants designated for a specific purpose–like a donation to a specific program or grant you have to spend within a calendar year.

EXAMPLE: If you receive a donation that’s explicitly for purchasing computers for an afterschool program, you can’t use that money to buy office chairs.

We call revenue from these sources restricted funds because you’re not free to use them however you please.

And the issue of restricted funds presents unique bookkeeping and accounting challenges for a nonprofit that a for-profit company doesn’t face.

To respond to those challenges, the nonprofit world uses a system of accounting called fund accounting. Fund accounting ensures you track restricted funds separately from unrestricted funds , so you can ensure you’re using funds correctly and demonstrate accountability to your donors.

Most not-for-profit organizations and entities–like 501(c)(3) charities, churches, religious institutions, government agencies, nonprofit nursing homes and hospitals, and educational institutions– are required to use fund accounting.

We’re going to focus specifically on how it’s applied to small and mid-sized nonprofits and charities. If you’re looking for info on fund accounting in government here is a great resource for you .

Both Generally Accepted Accounting Principles (GAAP) and Financial Accounting Standards Board (FASB) 116/117 require at least a minimum level of fund reporting, so you’ll need it in order to pass an audit.

If you’re a very small nonprofit, it’s possible you won’t have any restrictions on your donations. But once you start getting larger donations or grants, fund accounting quickly becomes a necessity.

Fund accounting is a system of accounting created to help not-for-profit organizations and agencies manage streams of revenue designated for specific purposes.

Fund accounting differs from for-profit accounting in that it prioritizes accountability, though it does add some complexity to the bookkeeping and accounting process.

As a nonprofit, you have to share your profitability, revenue streams, expense reports, and net assets with many different people, including the general public. And fund accounting ensures that you’re maintaining the degree of transparency required of you.

The core concept of fund accounting is the “funds.”

Think of each fund as a mini organization within your company, each with its own budget and financial statements that track revenue, expenses, liabilities, assets, and equity (net assets).

When a donation comes in, it’s assigned to a specific fund. Then you can track that money through your accounting system to see exactly how much is left, where it was spent, and how much value (net assets) it contributes to your organization.

The FASB requires that you set up at least 2 different “funds” within your accounts– one to track assets with donor-imposed restrictions, and one to track assets without donor-imposed restrictions. In many cases, though, you’re going to want to have more funds in order to optimize accuracy and transparency in your finances.

The two main fund designations are “restricted” and “unrestricted” funds, as mentioned above. But you’ll often want to break those out by the type of restriction (temporary vs. permanent) or the funding source.

Beyond that, you may want to track grants, endowments, or large-money funders in funds of their own. That makes it easy for you to run fund-level reports to share with your benefactors.

Here are some common fund designations you’ll find on the Statement of Financial Position of many nonprofits:

Unrestricted funds often make up the majority of donations for small nonprofits. These funds have no donor-imposed restrictions. So you can use this money for any organizational need that aligns with your legally declared mission.

Examples of unrestricted funds:

Temporarily restricted funds must be used for a specific purpose or within a specific period. In some cases, the money becomes unrestricted when a timeline ends or the objective is met. In other cases, unspent restricted funds may need to be returned to the grant maker or donor.

Examples of temporarily restricted funds:

Permanently restricted are typically large donations that function as investment accounts or an endowment fund. The money from the interest earned is designated for a specified purpose, and the principal cannot be touched.

Examples of permanently restricted funds:

If you have multiple endowments, grants or restricted large-dollar donations, it is recommended that you track them each in their own fund. Some organizations choose to track these funds outside of their official accounting structure (like in a spreadsheet), but setting up individual funds can help you establish transparency and accountability.

PRO TIP: The more exact and specific your accounting system, the more transparent it will be. And the more transparent your accounting system is, the more accountable you’ll be with the public and GAAP. Failure to accurately track restricted funds could jeopardize future contributions and your tax-exempt status.

When you set up funds in your chart of accounts, they’ll show on your financial statements as well. This adds transparency to your finances, but it also makes them a bit harder to read.

So let’s take a look at where you’ll see restricted funds on your financial reports:

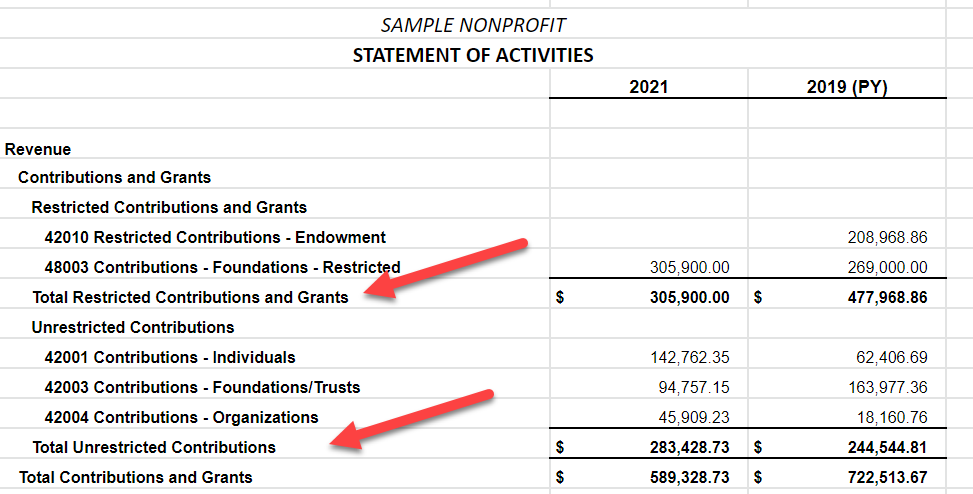

You’ll see restricted and unrestricted revenue segmented on your Statement of Activities. So you can see how much of the revenue you’ve generated in a certain timeframe as specific restrictions on its use:

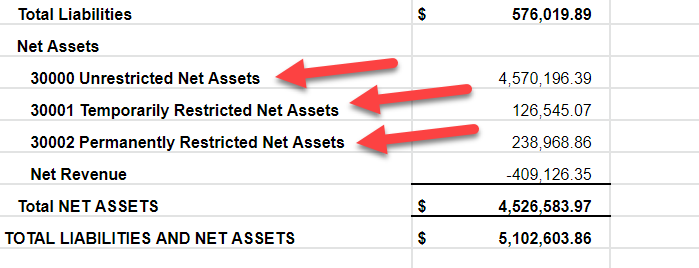

On your Statement of Financial Position, your fund accounts will pop up in the Assets section (restricted cash balances, restricted fixed assets) and in the Net Assets section (restricted and unrestricted net assets).

The principles behind fund accounting for nonprofits and charities are pretty simple. But the execution is another story.

If you’re not recording every transaction, every month, as it comes in. Otherwise, going back and reclassifying a whole year’s worth of expenses will drive you crazy. And inevitably lead to mistakes.

As leaders in the nonprofit accounting industry, The Charity CFO manages fund accounting for 120+ nonprofits nationwide with precision and expertise.

We can handle your bookkeeping and accounting to deliver accurate financial statements every month that let you know which money you can spend, for which purpose, and when you can spend it.

Unlike most accounting firms, we work exclusively with nonprofit organizations like yours. So there’s nothing your organization can throw at us that we’re not prepared to handle.

Is it time to simplify your accounting process so you can finally focus on your mission?

Reach out to us today for a free consultation.

Get our FREE GUIDE to nonprofit financial reports, featuring illustrations, annotations, and insights to help you better understand your organization's finances.